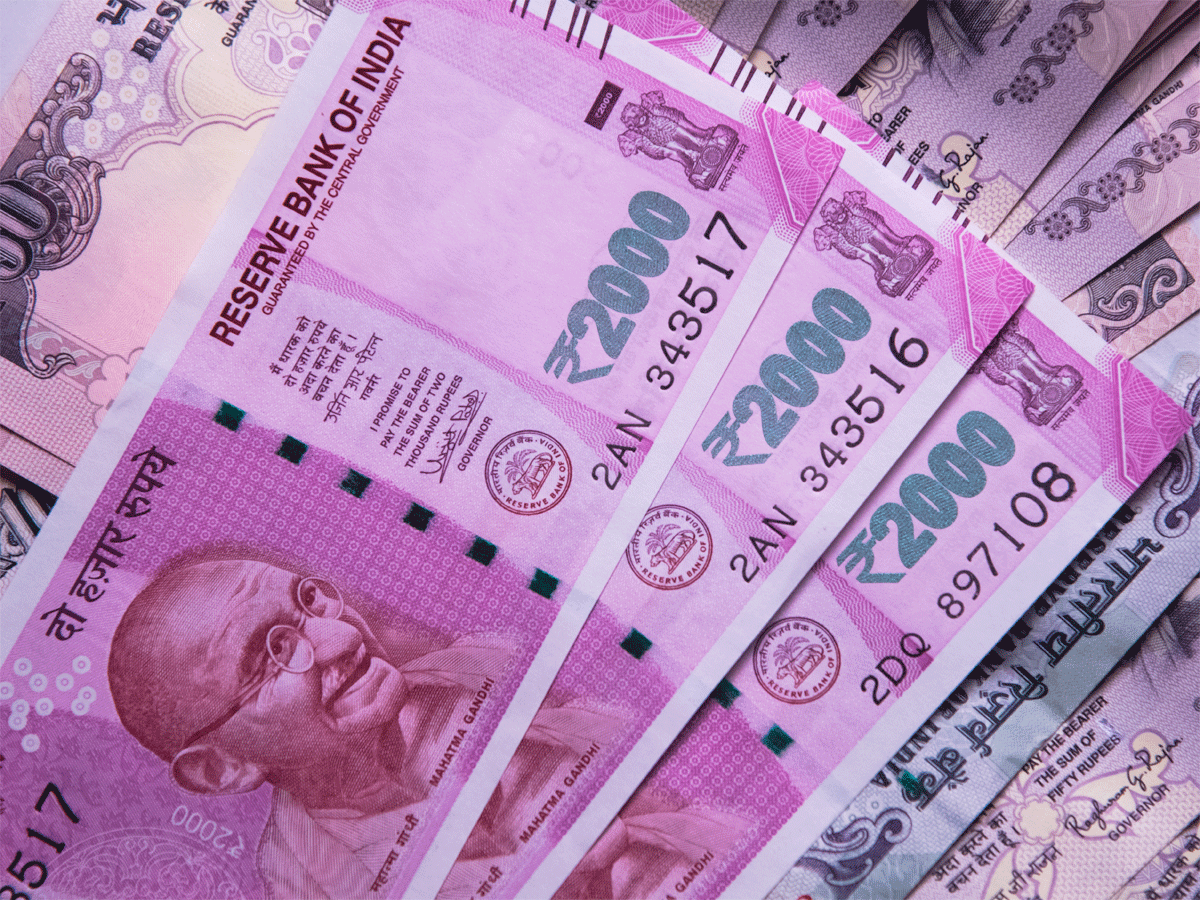

A senior official told ET that the government has asked public sector banks (PSBs) to focus on written-off loans and try to recover at least ₹2 lakh crore in this financial year.

A senior official told ET that the government has asked public sector banks (PSBs) to focus on written-off loans and try to recover at least ₹2 lakh crore in this financial year.source https://economictimes.indiatimes.com/industry/banking/finance/banking/special-drive-by-public-sector-banks-likely-to-recover-written-off-loans/articleshow/99894437.cms