Mody is a 1982-batch Indian Revenue Service officer, was appointed as the CBDT chief in February 2019.

Mody is a 1982-batch Indian Revenue Service officer, was appointed as the CBDT chief in February 2019.from Banking/Finance-Industry-Economic Times https://ift.tt/3dVT58A

via IFTTT

bank, NBFC, loan, Credit Card ,General Awareness, finance knowledge RBI, saving account,current account, Fixed Deposit ,Recurring Deposit (RD) ,General Banking scheme ,

Mody is a 1982-batch Indian Revenue Service officer, was appointed as the CBDT chief in February 2019.

Mody is a 1982-batch Indian Revenue Service officer, was appointed as the CBDT chief in February 2019. Since financial institutions are within the administrative control of the finance ministry, these will no doubt have early implementation. There have also been statements from the Reserve Bank governor of the nature of the ARC that will be set up. These actions portend that GoI will walk the talk.

Since financial institutions are within the administrative control of the finance ministry, these will no doubt have early implementation. There have also been statements from the Reserve Bank governor of the nature of the ARC that will be set up. These actions portend that GoI will walk the talk. Since financial institutions are within the administrative control of the finance ministry, these will no doubt have early implementation. There have also been statements from the Reserve Bank governor of the nature of the ARC that will be set up. These actions portend that GoI will walk the talk.

Since financial institutions are within the administrative control of the finance ministry, these will no doubt have early implementation. There have also been statements from the Reserve Bank governor of the nature of the ARC that will be set up. These actions portend that GoI will walk the talk. The platform was conceptualised based on a research done during the pandemic that small businesses need to digitise their offerings to meet stiff competition from big brands and shopping apps and portals.

The platform was conceptualised based on a research done during the pandemic that small businesses need to digitise their offerings to meet stiff competition from big brands and shopping apps and portals. Most health insurance provides no-claim bonus for claim-free years but that usually ranges from 25 per cent to 50 per cent.

Most health insurance provides no-claim bonus for claim-free years but that usually ranges from 25 per cent to 50 per cent. The Union Budget 2021-22 presented in Parliament earlier this month proposed to set up a Development Finance Institution (DFI) with an initial capital of Rs 20,000 crore to fund the Rs 111 lakh crore ambitious National Infrastructure Pipeline (NIP).

The Union Budget 2021-22 presented in Parliament earlier this month proposed to set up a Development Finance Institution (DFI) with an initial capital of Rs 20,000 crore to fund the Rs 111 lakh crore ambitious National Infrastructure Pipeline (NIP). The Union Budget 2021-22 presented in Parliament earlier this month proposed to set up a Development Finance Institution (DFI) with an initial capital of Rs 20,000 crore to fund the Rs 111 lakh crore ambitious National Infrastructure Pipeline (NIP).

The Union Budget 2021-22 presented in Parliament earlier this month proposed to set up a Development Finance Institution (DFI) with an initial capital of Rs 20,000 crore to fund the Rs 111 lakh crore ambitious National Infrastructure Pipeline (NIP). The survey found that most consumers would like to buy life insurance in the next six months as part of their investment plans.

The survey found that most consumers would like to buy life insurance in the next six months as part of their investment plans. The private sector lender said it will seek approval from the shareholders through an ordinary resolution for the required reclassification.

The private sector lender said it will seek approval from the shareholders through an ordinary resolution for the required reclassification. The submission was made before Justice Prathiba M Singh by Additional Solicitor General (ASG) Chetan Sharma who said the committee held a meeting on February 23 and another is scheduled on March 4 after which it would submit its final report.

The submission was made before Justice Prathiba M Singh by Additional Solicitor General (ASG) Chetan Sharma who said the committee held a meeting on February 23 and another is scheduled on March 4 after which it would submit its final report. "We are delighted to partner with one of the leading players in general insurance businesses-SBI General Insurance. We will efficiently nurture it to be a long running mutually beneficial relationship", the bank's Managing Director Partha Pratim Sengupta said.

"We are delighted to partner with one of the leading players in general insurance businesses-SBI General Insurance. We will efficiently nurture it to be a long running mutually beneficial relationship", the bank's Managing Director Partha Pratim Sengupta said. "We are delighted to partner with one of the leading players in general insurance businesses-SBI General Insurance. We will efficiently nurture it to be a long running mutually beneficial relationship", the bank's Managing Director Partha Pratim Sengupta said.

"We are delighted to partner with one of the leading players in general insurance businesses-SBI General Insurance. We will efficiently nurture it to be a long running mutually beneficial relationship", the bank's Managing Director Partha Pratim Sengupta said. Deliberating on what the future holds for digital payments in India, Sajith Sivanandan, MD & Business Head - Google Pay & Next Billion User Initiative, Google India, and T.R. Ramachandran, Group Country Manager - India & South Asia, VISA, said the primary requirement was to make payments seamless.

Deliberating on what the future holds for digital payments in India, Sajith Sivanandan, MD & Business Head - Google Pay & Next Billion User Initiative, Google India, and T.R. Ramachandran, Group Country Manager - India & South Asia, VISA, said the primary requirement was to make payments seamless. Deliberating on what the future holds for digital payments in India, Sajith Sivanandan, MD & Business Head - Google Pay & Next Billion User Initiative, Google India, and T.R. Ramachandran, Group Country Manager - India & South Asia, VISA, said the primary requirement was to make payments seamless.

Deliberating on what the future holds for digital payments in India, Sajith Sivanandan, MD & Business Head - Google Pay & Next Billion User Initiative, Google India, and T.R. Ramachandran, Group Country Manager - India & South Asia, VISA, said the primary requirement was to make payments seamless. Panellists at the ET India Inc Boardroom emphasised the need for banks to invest in digital technology to bring down costs, and drive better delivery.

Panellists at the ET India Inc Boardroom emphasised the need for banks to invest in digital technology to bring down costs, and drive better delivery. While stating that it has enabled loans to over 1.1 lakh merchants across over 75 cities in India, BharatPe said it is likely to end up facilitating disbursals of Rs 1,250 crores in FY 21.

While stating that it has enabled loans to over 1.1 lakh merchants across over 75 cities in India, BharatPe said it is likely to end up facilitating disbursals of Rs 1,250 crores in FY 21. "With the objective of having a standard product with common coverage and policy wordings across the industry, the authority has decided to mandate all general and health insurers to offer the standard personal accident insurance product," Irdai said.

"With the objective of having a standard product with common coverage and policy wordings across the industry, the authority has decided to mandate all general and health insurers to offer the standard personal accident insurance product," Irdai said. "With the objective of having a standard product with common coverage and policy wordings across the industry, the authority has decided to mandate all general and health insurers to offer the standard personal accident insurance product," Irdai said.

"With the objective of having a standard product with common coverage and policy wordings across the industry, the authority has decided to mandate all general and health insurers to offer the standard personal accident insurance product," Irdai said. “Private enterprises are being promoted wherever possible, still, along with this, an effective participation of the public sector in banking and insurance is still needed by the country,” he said in a webinar on effective implementation of Budget provisions regarding financial services.

“Private enterprises are being promoted wherever possible, still, along with this, an effective participation of the public sector in banking and insurance is still needed by the country,” he said in a webinar on effective implementation of Budget provisions regarding financial services. “Private enterprises are being promoted wherever possible, still, along with this, an effective participation of the public sector in banking and insurance is still needed by the country,” he said in a webinar on effective implementation of Budget provisions regarding financial services.

“Private enterprises are being promoted wherever possible, still, along with this, an effective participation of the public sector in banking and insurance is still needed by the country,” he said in a webinar on effective implementation of Budget provisions regarding financial services. The offering is the new version of its flagship product Activ Health, which provides a comprehensive health protection with extensive wellness benefits, the company said on Friday.

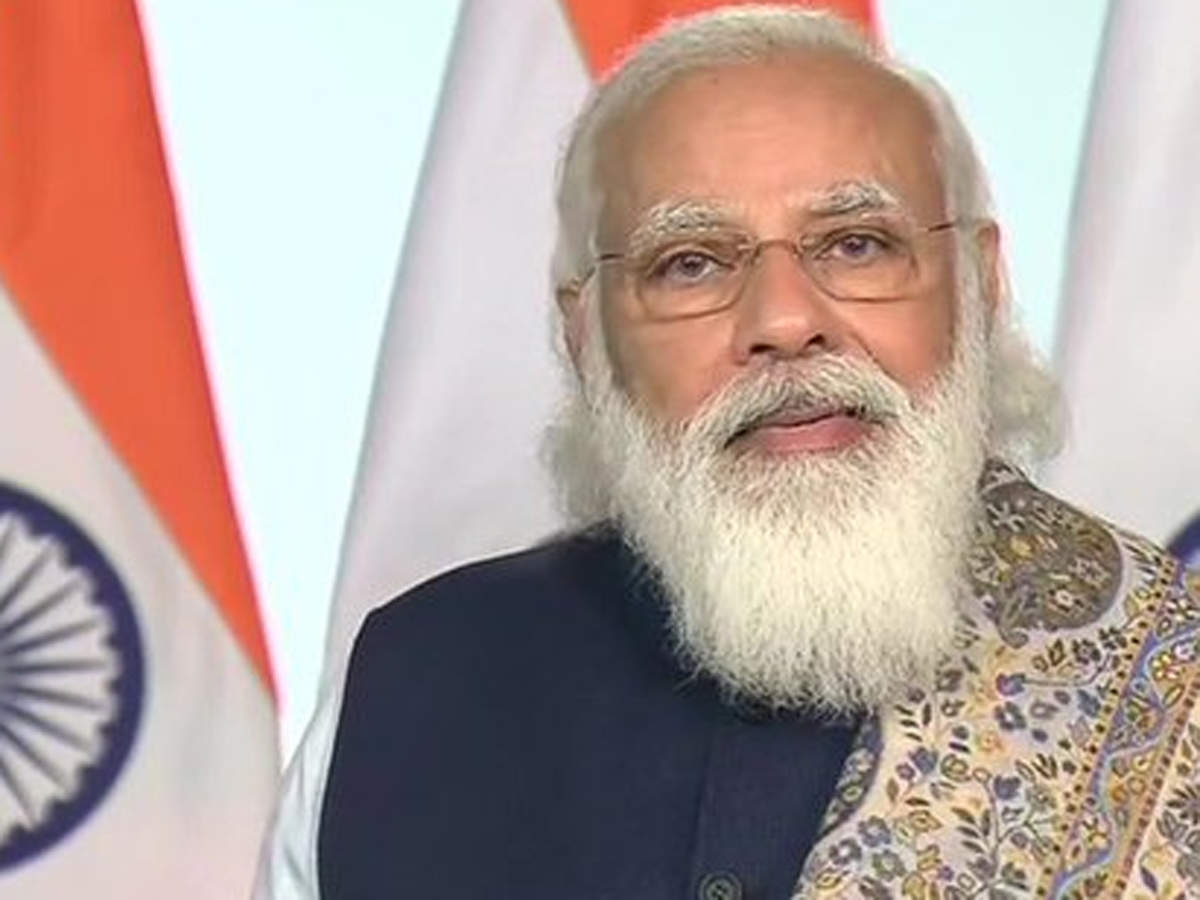

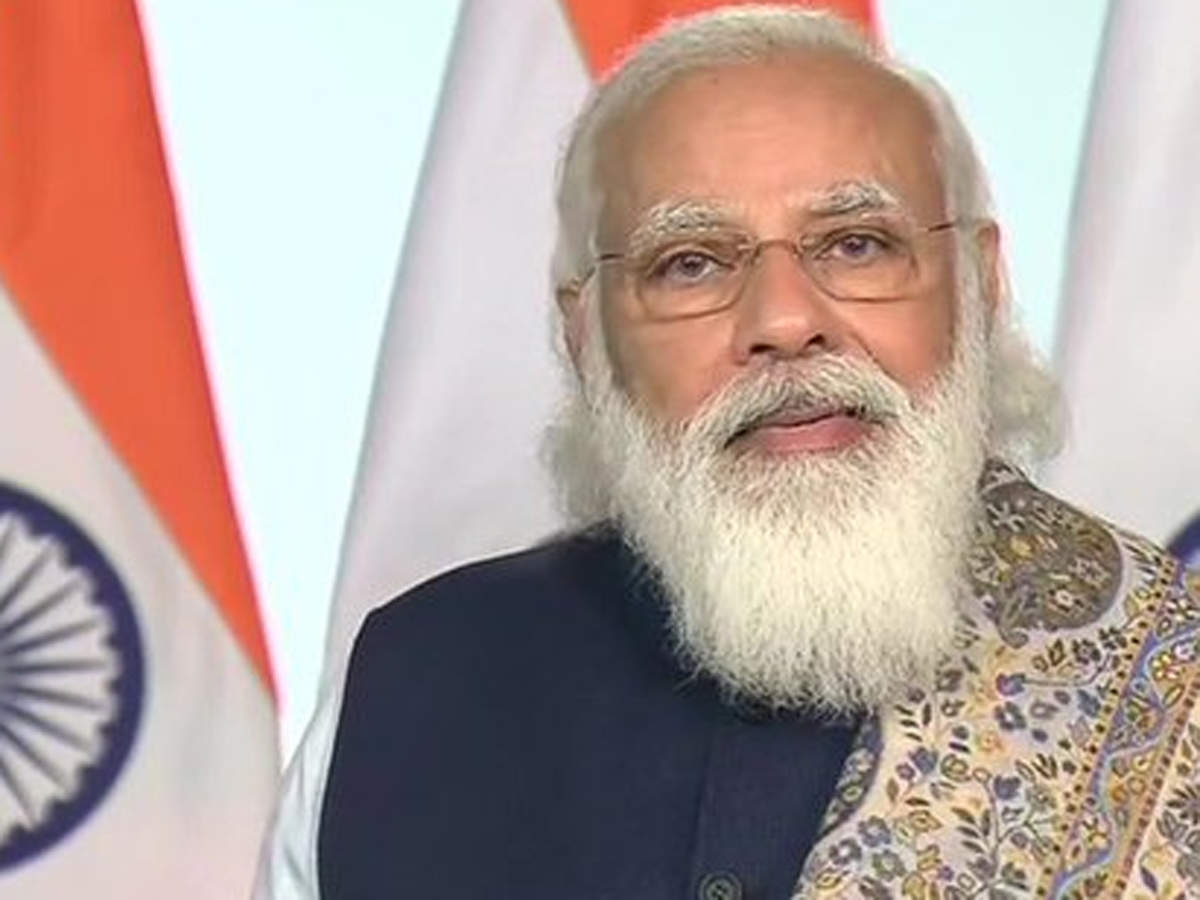

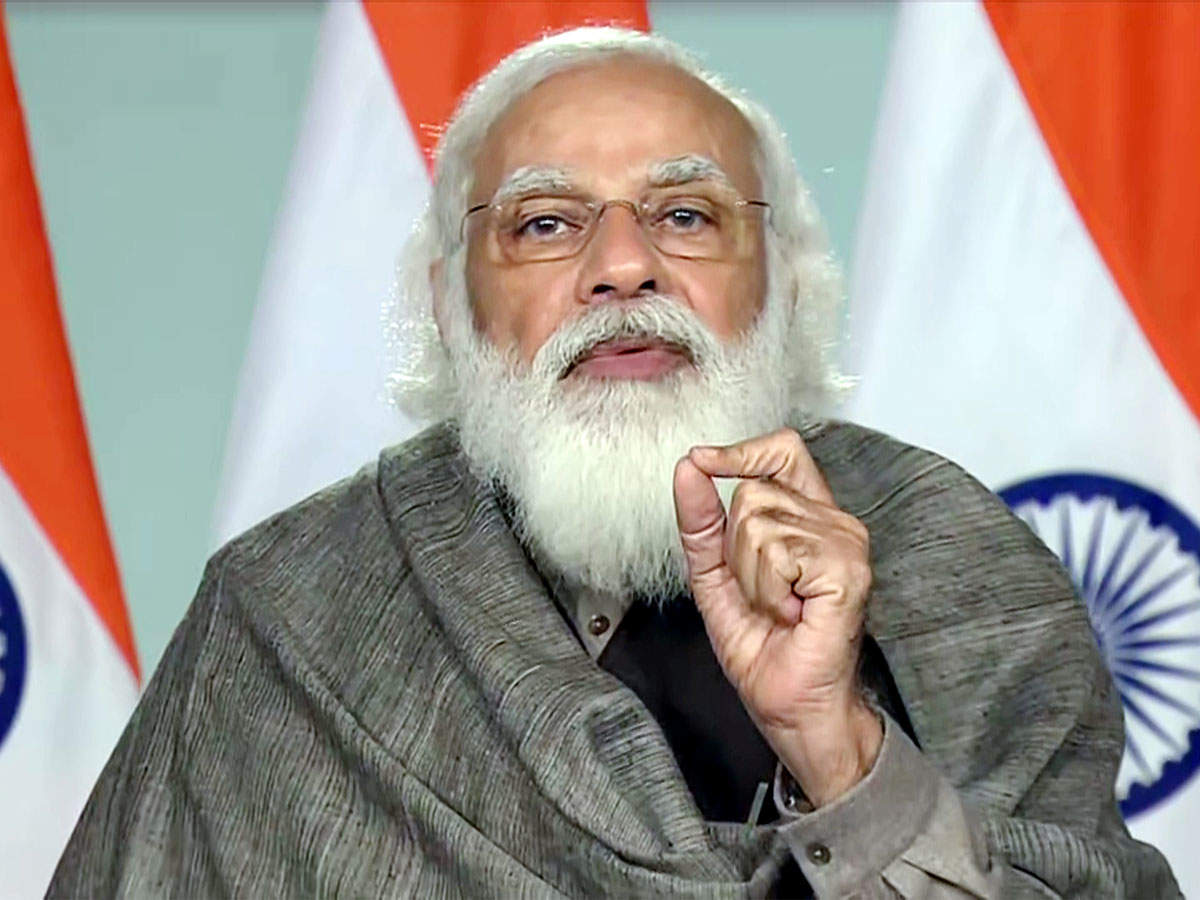

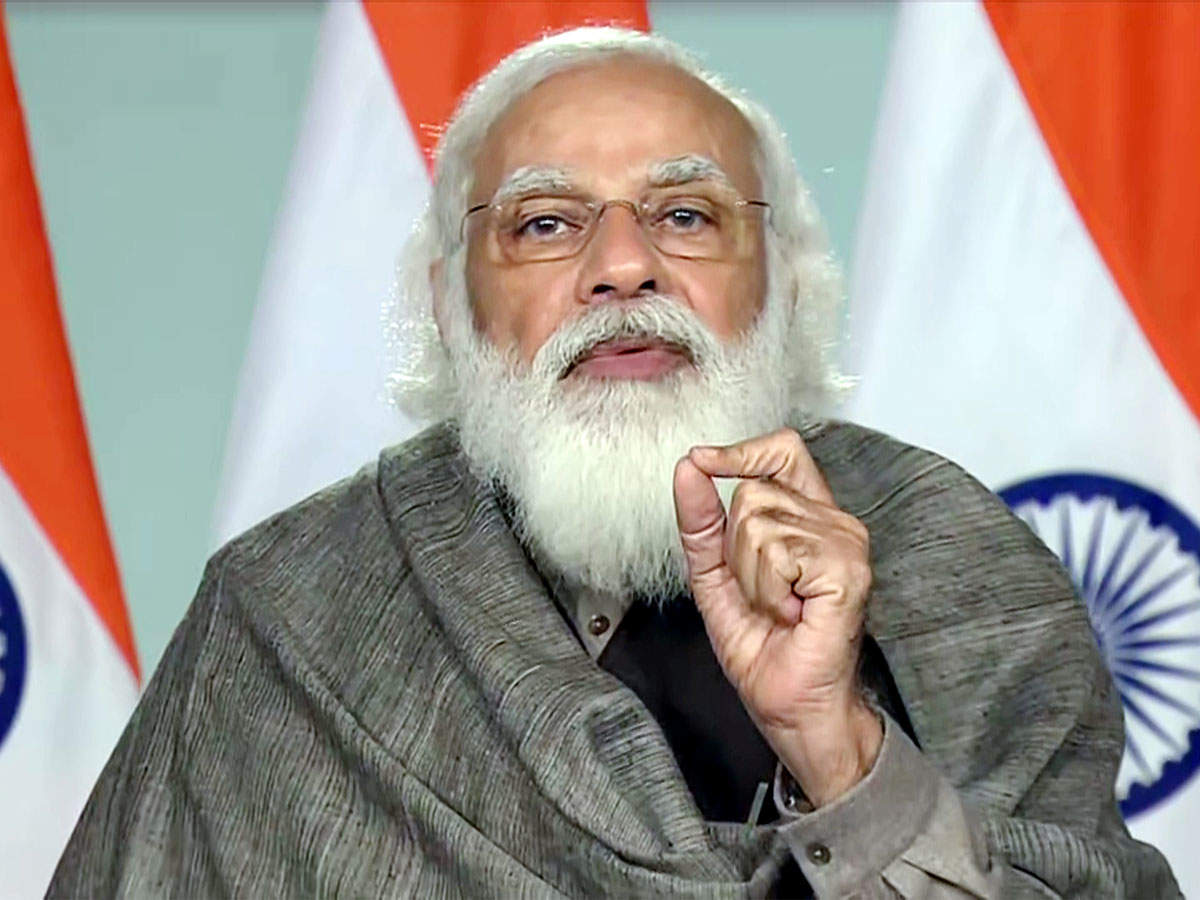

The offering is the new version of its flagship product Activ Health, which provides a comprehensive health protection with extensive wellness benefits, the company said on Friday. "As our economy is growing, and growing fast, credit flow has also become equally important. You have to see how credit reaches new sectors, new entrepreneurs. Now you will have to focus on creation of new and better financial products for Startups and Fintech," Modi said.

"As our economy is growing, and growing fast, credit flow has also become equally important. You have to see how credit reaches new sectors, new entrepreneurs. Now you will have to focus on creation of new and better financial products for Startups and Fintech," Modi said. "As our economy is growing, and growing fast, credit flow has also become equally important. You have to see how credit reaches new sectors, new entrepreneurs. Now you will have to focus on creation of new and better financial products for Startups and Fintech," Modi said.

"As our economy is growing, and growing fast, credit flow has also become equally important. You have to see how credit reaches new sectors, new entrepreneurs. Now you will have to focus on creation of new and better financial products for Startups and Fintech," Modi said. According to banking sources, lenders have already identified corporate loans of over Rs 1.5 lakh crore to be transferred to the NARC, which will be promoted in the public sector. The NARC will offer to purchase bad loans at a negotiated rate. However, once a negotiated rate is struck, private ARCs will be allowed to better the bid.

According to banking sources, lenders have already identified corporate loans of over Rs 1.5 lakh crore to be transferred to the NARC, which will be promoted in the public sector. The NARC will offer to purchase bad loans at a negotiated rate. However, once a negotiated rate is struck, private ARCs will be allowed to better the bid. According to banking sources, lenders have already identified corporate loans of over Rs 1.5 lakh crore to be transferred to the NARC, which will be promoted in the public sector. The NARC will offer to purchase bad loans at a negotiated rate. However, once a negotiated rate is struck, private ARCs will be allowed to better the bid.

According to banking sources, lenders have already identified corporate loans of over Rs 1.5 lakh crore to be transferred to the NARC, which will be promoted in the public sector. The NARC will offer to purchase bad loans at a negotiated rate. However, once a negotiated rate is struck, private ARCs will be allowed to better the bid. The case involves one where Citibank acted as an administrative agent for a term loan taken by Revlon, and where it was to wire approximately $7.8 million in interest payments to Revlon’s lenders. Instead, Citibank wired almost $900 million. It mistakenly sent the principal amount too.

The case involves one where Citibank acted as an administrative agent for a term loan taken by Revlon, and where it was to wire approximately $7.8 million in interest payments to Revlon’s lenders. Instead, Citibank wired almost $900 million. It mistakenly sent the principal amount too. The case involves one where Citibank acted as an administrative agent for a term loan taken by Revlon, and where it was to wire approximately $7.8 million in interest payments to Revlon’s lenders. Instead, Citibank wired almost $900 million. It mistakenly sent the principal amount too.

The case involves one where Citibank acted as an administrative agent for a term loan taken by Revlon, and where it was to wire approximately $7.8 million in interest payments to Revlon’s lenders. Instead, Citibank wired almost $900 million. It mistakenly sent the principal amount too. Central bank governor Shaktikanta Das said the proposed bad bank, considered crucial in helping extract capital stuck in soured loans, will be a new asset reconstruction company (ARC) set up by public sector lenders to take over bad assets.

Central bank governor Shaktikanta Das said the proposed bad bank, considered crucial in helping extract capital stuck in soured loans, will be a new asset reconstruction company (ARC) set up by public sector lenders to take over bad assets. Central bank governor Shaktikanta Das said the proposed bad bank, considered crucial in helping extract capital stuck in soured loans, will be a new asset reconstruction company (ARC) set up by public sector lenders to take over bad assets.

Central bank governor Shaktikanta Das said the proposed bad bank, considered crucial in helping extract capital stuck in soured loans, will be a new asset reconstruction company (ARC) set up by public sector lenders to take over bad assets. In November 2019, the Reserve Bank had referred DHFL, the third-largest pure-play mortgage lender, to the National Company Law Tribunal (NCLT) for insolvency proceedings.

In November 2019, the Reserve Bank had referred DHFL, the third-largest pure-play mortgage lender, to the National Company Law Tribunal (NCLT) for insolvency proceedings. The standardized product set to go live from April 1 has been named “Saral Suraksha Bima.” The minimum sum assured has been set as Rs 2.5 lakh.

The standardized product set to go live from April 1 has been named “Saral Suraksha Bima.” The minimum sum assured has been set as Rs 2.5 lakh. The bank is offering customised loans in Chhattisgarh, Karnataka, Andhra Pradesh, Telangana, Madhya Pradesh, Maharashtra, Odisha and Rajasthan, which saw a growth in demand last year.

The bank is offering customised loans in Chhattisgarh, Karnataka, Andhra Pradesh, Telangana, Madhya Pradesh, Maharashtra, Odisha and Rajasthan, which saw a growth in demand last year. Under the amended Companies Act, 2013 and the Nidhi Rules, 2014, companies need to get themselves updated or declared as Nidhi company by applying to the Ministry of Corporate Affairs (MCA) in form NDH-4.

Under the amended Companies Act, 2013 and the Nidhi Rules, 2014, companies need to get themselves updated or declared as Nidhi company by applying to the Ministry of Corporate Affairs (MCA) in form NDH-4. Das also added that just like non-bank lenders the RBI was internally working on refining and strengthening guidelines governing asset reconstruction companies.

Das also added that just like non-bank lenders the RBI was internally working on refining and strengthening guidelines governing asset reconstruction companies. The merger that will create one of India's largest listed property development platforms has received nod from anti-monopoly watchdog the Competition Commission of India (CCI). It has also received regulatory approvals from the NSE, BSE, capital market regulator Securities & Exchange Board of India (SEBI).

The merger that will create one of India's largest listed property development platforms has received nod from anti-monopoly watchdog the Competition Commission of India (CCI). It has also received regulatory approvals from the NSE, BSE, capital market regulator Securities & Exchange Board of India (SEBI). The merger that will create one of India's largest listed property development platforms has received nod from anti-monopoly watchdog the Competition Commission of India (CCI). It has also received regulatory approvals from the NSE, BSE, capital market regulator Securities & Exchange Board of India (SEBI).

The merger that will create one of India's largest listed property development platforms has received nod from anti-monopoly watchdog the Competition Commission of India (CCI). It has also received regulatory approvals from the NSE, BSE, capital market regulator Securities & Exchange Board of India (SEBI). As per the proposed transaction, Axis Entities have the right to acquire up to 19% stake in Max Life, of which, Axis Bank proposes to acquire up to 9%, and Axis Capital Limited and Axis Securities Limited together propose to acquire up to 3% of the share capital of Max Life in the first leg of the transaction.

As per the proposed transaction, Axis Entities have the right to acquire up to 19% stake in Max Life, of which, Axis Bank proposes to acquire up to 9%, and Axis Capital Limited and Axis Securities Limited together propose to acquire up to 3% of the share capital of Max Life in the first leg of the transaction.