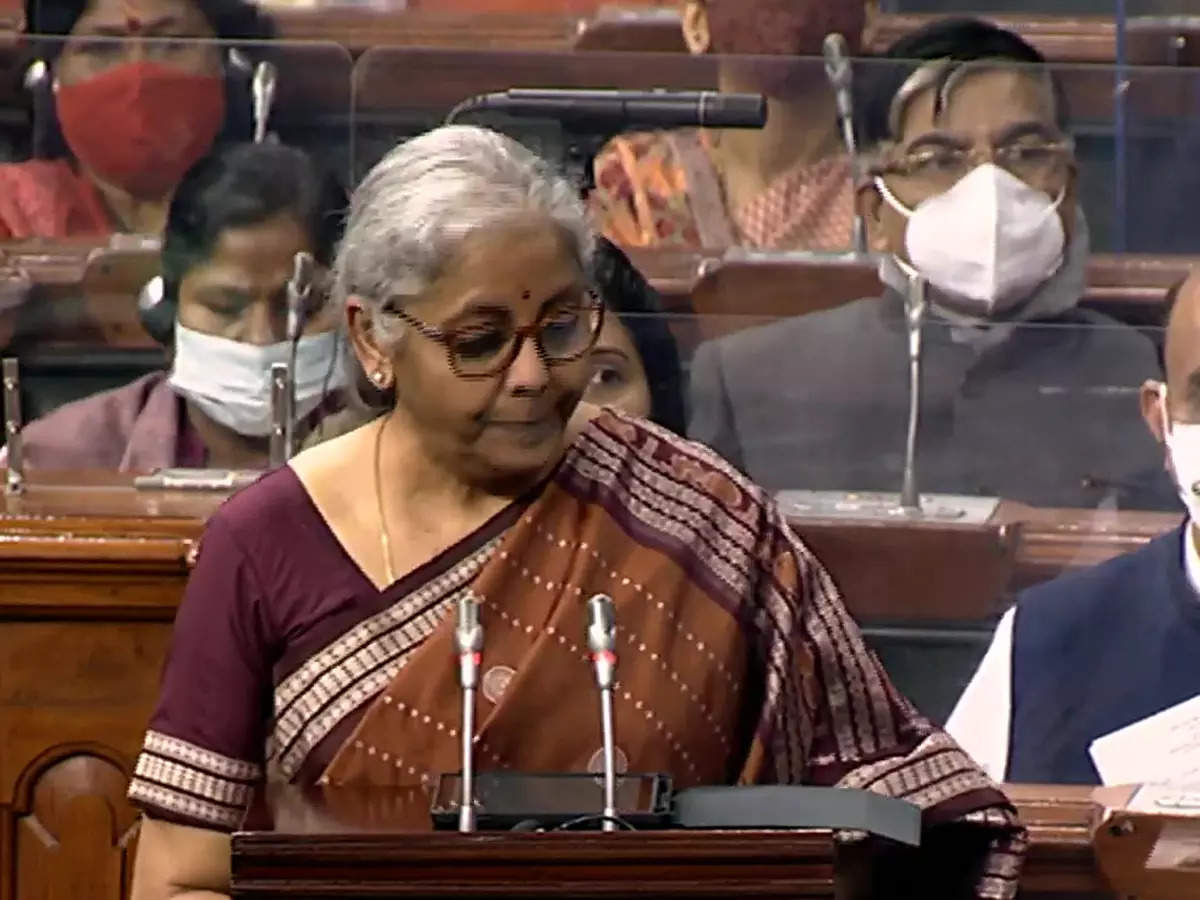

Finance minister Nirmala Sitharaman also announced to set up 75 digital banking centres in 75 districts by scheduled commercial banks.

Finance minister Nirmala Sitharaman also announced to set up 75 digital banking centres in 75 districts by scheduled commercial banks.from Banking/Finance-Industry-Economic Times https://ift.tt/ygT01nxVG

via IFTTT

bank, NBFC, loan, Credit Card ,General Awareness, finance knowledge RBI, saving account,current account, Fixed Deposit ,Recurring Deposit (RD) ,General Banking scheme ,

The cold chain industry has had to accommodate for the lack of assets and infrastructure by working overtime for the last two years. Onboarding native entrepreneurs and helping them start their cold chain journey will give the industry more assets to work with, said Swarup Bose, founder and CEO, Celcius.

The cold chain industry has had to accommodate for the lack of assets and infrastructure by working overtime for the last two years. Onboarding native entrepreneurs and helping them start their cold chain journey will give the industry more assets to work with, said Swarup Bose, founder and CEO, Celcius. The city police had earlier arrested the promoter, Ajay Ajit Peter Kerkar, and former chief financial officer Anil Khandelwal, who are now in jail in the case.

The city police had earlier arrested the promoter, Ajay Ajit Peter Kerkar, and former chief financial officer Anil Khandelwal, who are now in jail in the case. These suggestions have been made in the investor feedback sought by KPMG, the transaction advisor for the IDBI Bank strategic sale, according to officials with knowledge of the matter.

These suggestions have been made in the investor feedback sought by KPMG, the transaction advisor for the IDBI Bank strategic sale, according to officials with knowledge of the matter. Several individuals - including those who were investigated, re-assessed and taxed - have been asked by the Foreign Assets Investigation Unit (FAIU) to share details of offshore bank accounts since 2001, residency status for the past two decades, passport copies and names of overseas service providers. Overseas service providers are professional outfits setting up tax haven vehicles and trusts to hold the funds.

Several individuals - including those who were investigated, re-assessed and taxed - have been asked by the Foreign Assets Investigation Unit (FAIU) to share details of offshore bank accounts since 2001, residency status for the past two decades, passport copies and names of overseas service providers. Overseas service providers are professional outfits setting up tax haven vehicles and trusts to hold the funds. Several individuals - including those who were investigated, re-assessed and taxed - have been asked by the Foreign Assets Investigation Unit (FAIU) to share details of offshore bank accounts since 2001, residency status for the past two decades, passport copies and names of overseas service providers. Overseas service providers are professional outfits setting up tax haven vehicles and trusts to hold the funds.

Several individuals - including those who were investigated, re-assessed and taxed - have been asked by the Foreign Assets Investigation Unit (FAIU) to share details of offshore bank accounts since 2001, residency status for the past two decades, passport copies and names of overseas service providers. Overseas service providers are professional outfits setting up tax haven vehicles and trusts to hold the funds. The bank said, "In view of the public sentiments, SBI has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter."

The bank said, "In view of the public sentiments, SBI has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter." The bank said, "In view of the public sentiments, SBI has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter."

The bank said, "In view of the public sentiments, SBI has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter." The company, a wholly-owned subsidiary of Piramal Enterprises Limited, continues to hire extensively for retail operations pan-India and has rolled out 2,000 offers already in the last three months in the merged entity.

The company, a wholly-owned subsidiary of Piramal Enterprises Limited, continues to hire extensively for retail operations pan-India and has rolled out 2,000 offers already in the last three months in the merged entity. The company, a wholly-owned subsidiary of Piramal Enterprises Limited, continues to hire extensively for retail operations pan-India and has rolled out 2,000 offers already in the last three months in the merged entity.

The company, a wholly-owned subsidiary of Piramal Enterprises Limited, continues to hire extensively for retail operations pan-India and has rolled out 2,000 offers already in the last three months in the merged entity. In view of the public sentiments, SBI has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter, the bank said in a statement. In its latest medical fitness guidelines for new recruits or promotees, the bank said a candidate would be considered fit in case of pregnancy which is less than three months.

In view of the public sentiments, SBI has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter, the bank said in a statement. In its latest medical fitness guidelines for new recruits or promotees, the bank said a candidate would be considered fit in case of pregnancy which is less than three months. In view of the public sentiments, SBI has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter, the bank said in a statement. In its latest medical fitness guidelines for new recruits or promotees, the bank said a candidate would be considered fit in case of pregnancy which is less than three months.

In view of the public sentiments, SBI has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter, the bank said in a statement. In its latest medical fitness guidelines for new recruits or promotees, the bank said a candidate would be considered fit in case of pregnancy which is less than three months. The bank's move has elicited criticism from some quarters, including from the All India State Bank of India Employees' Association. In its latest medical fitness guidelines for new recruits or promotees, the bank said a candidate would be considered fit in case of pregnancy which is less than 3 months.

The bank's move has elicited criticism from some quarters, including from the All India State Bank of India Employees' Association. In its latest medical fitness guidelines for new recruits or promotees, the bank said a candidate would be considered fit in case of pregnancy which is less than 3 months. The bank's move has elicited criticism from some quarters, including from the All India State Bank of India Employees' Association. In its latest medical fitness guidelines for new recruits or promotees, the bank said a candidate would be considered fit in case of pregnancy which is less than 3 months.

The bank's move has elicited criticism from some quarters, including from the All India State Bank of India Employees' Association. In its latest medical fitness guidelines for new recruits or promotees, the bank said a candidate would be considered fit in case of pregnancy which is less than 3 months. In a statement, RBI said the Lucknow-based co-operative bank will not, without its prior approval, grant or renew any loans and advances, or make any investment.

In a statement, RBI said the Lucknow-based co-operative bank will not, without its prior approval, grant or renew any loans and advances, or make any investment. It is easy to increase your budget by cutting down your investments and savings, but that is not the best way to do it. Cutting down your investments and saving can jeopardize your financial future.

It is easy to increase your budget by cutting down your investments and savings, but that is not the best way to do it. Cutting down your investments and saving can jeopardize your financial future. “Future Enterprises progresses on its plans to monetise its investment in its insurance joint ventures with Generali, agrees to sell 25% equity in the general insurance JV,” Future Enterprises Ltd said in a filing to the stock exchanges.

“Future Enterprises progresses on its plans to monetise its investment in its insurance joint ventures with Generali, agrees to sell 25% equity in the general insurance JV,” Future Enterprises Ltd said in a filing to the stock exchanges. “Future Enterprises progresses on its plans to monetise its investment in its insurance joint ventures with Generali, agrees to sell 25% equity in the general insurance JV,” Future Enterprises Ltd said in a filing to the stock exchanges.

“Future Enterprises progresses on its plans to monetise its investment in its insurance joint ventures with Generali, agrees to sell 25% equity in the general insurance JV,” Future Enterprises Ltd said in a filing to the stock exchanges. "FEL has agreed to sell a 25 per cent stake in its General Insurance Joint Venture, FGIICL, to its Joint Venture partner Generali for a cash consideration of Rs 1,252.96 crore, plus an additional consideration that is linked to the date of the closing of the transaction," the regulatory filing by the Future Group firm said.

"FEL has agreed to sell a 25 per cent stake in its General Insurance Joint Venture, FGIICL, to its Joint Venture partner Generali for a cash consideration of Rs 1,252.96 crore, plus an additional consideration that is linked to the date of the closing of the transaction," the regulatory filing by the Future Group firm said. "FEL has agreed to sell a 25 per cent stake in its General Insurance Joint Venture, FGIICL, to its Joint Venture partner Generali for a cash consideration of Rs 1,252.96 crore, plus an additional consideration that is linked to the date of the closing of the transaction," the regulatory filing by the Future Group firm said.

"FEL has agreed to sell a 25 per cent stake in its General Insurance Joint Venture, FGIICL, to its Joint Venture partner Generali for a cash consideration of Rs 1,252.96 crore, plus an additional consideration that is linked to the date of the closing of the transaction," the regulatory filing by the Future Group firm said. “The scheme of amalgamation envisages takeover of the assets and liabilities of PMC Bank, including deposits, by the USFBL in terms of the provisions of the scheme,” the Reserve Bank of India said citing the government's sanction on the amalgamation plan.

“The scheme of amalgamation envisages takeover of the assets and liabilities of PMC Bank, including deposits, by the USFBL in terms of the provisions of the scheme,” the Reserve Bank of India said citing the government's sanction on the amalgamation plan. "The amalgamation will come into force with effect from the date of the notification of the scheme i.e. January 25, 2022. All the branches of the PMC Bank will function as branches of Unity Small Finance Bank Ltd. with effect from this date," read the circular in the official site of the Reserve Bank of India.

"The amalgamation will come into force with effect from the date of the notification of the scheme i.e. January 25, 2022. All the branches of the PMC Bank will function as branches of Unity Small Finance Bank Ltd. with effect from this date," read the circular in the official site of the Reserve Bank of India. "Indian banks are ready to shift into a growth phase, just in time to meet rising demand as the country's economy recovers," said Nikita Anand, associate director for credit risk at S&P Global Ratings. "Faster loan growth will be bolstered by improving asset quality and a normalization in credit costs over the next 12-18 months."

"Indian banks are ready to shift into a growth phase, just in time to meet rising demand as the country's economy recovers," said Nikita Anand, associate director for credit risk at S&P Global Ratings. "Faster loan growth will be bolstered by improving asset quality and a normalization in credit costs over the next 12-18 months." The AP Mahesh Co-operative Urban Bank authorities after detecting suspicious transactions on Sunday night were able to stop further transfer of funds/transactions and also contacted managements of those banks to block such accounts and managed to get some amount (from the diverted funds) frozen, he said.

The AP Mahesh Co-operative Urban Bank authorities after detecting suspicious transactions on Sunday night were able to stop further transfer of funds/transactions and also contacted managements of those banks to block such accounts and managed to get some amount (from the diverted funds) frozen, he said. The AP Mahesh Co-operative Urban Bank authorities after detecting suspicious transactions on Sunday night were able to stop further transfer of funds/transactions and also contacted managements of those banks to block such accounts and managed to get some amount (from the diverted funds) frozen, he said.

The AP Mahesh Co-operative Urban Bank authorities after detecting suspicious transactions on Sunday night were able to stop further transfer of funds/transactions and also contacted managements of those banks to block such accounts and managed to get some amount (from the diverted funds) frozen, he said. "The securitisation volumes in Q4 (FY22), which should have otherwise seen a healthy improvement, could be impacted by the concerns around the third wave of COVID infections that may affect the repayment capabilities of the borrowers who have a marginal financial profile," the rating agency said in a report released on Tuesday.

"The securitisation volumes in Q4 (FY22), which should have otherwise seen a healthy improvement, could be impacted by the concerns around the third wave of COVID infections that may affect the repayment capabilities of the borrowers who have a marginal financial profile," the rating agency said in a report released on Tuesday. "The securitisation volumes in Q4 (FY22), which should have otherwise seen a healthy improvement, could be impacted by the concerns around the third wave of COVID infections that may affect the repayment capabilities of the borrowers who have a marginal financial profile," the rating agency said in a report released on Tuesday.

"The securitisation volumes in Q4 (FY22), which should have otherwise seen a healthy improvement, could be impacted by the concerns around the third wave of COVID infections that may affect the repayment capabilities of the borrowers who have a marginal financial profile," the rating agency said in a report released on Tuesday. Hero Fincorp has initiated a valuation exercise before the equity funding round will be finalised. The final contributions of the existing and new investors could change based on the valuation report, according to people cited.

Hero Fincorp has initiated a valuation exercise before the equity funding round will be finalised. The final contributions of the existing and new investors could change based on the valuation report, according to people cited. Hero Fincorp has initiated a valuation exercise before the equity funding round will be finalised. The final contributions of the existing and new investors could change based on the valuation report, according to people cited.

Hero Fincorp has initiated a valuation exercise before the equity funding round will be finalised. The final contributions of the existing and new investors could change based on the valuation report, according to people cited. Even as the wait goes on for the National Asset Reconstruction Company (NARC), or 'bad bank', which was announced in the previous Union Budget and proposed reforms for the private asset reconstruction companies (ARCs) to take off, the dead weight of old accounts continues to languish on the banks' books.

Even as the wait goes on for the National Asset Reconstruction Company (NARC), or 'bad bank', which was announced in the previous Union Budget and proposed reforms for the private asset reconstruction companies (ARCs) to take off, the dead weight of old accounts continues to languish on the banks' books. India has about 200,000 villages with a population of more than 2000 people. The company is focused on targeting this demographic through an assisted model that consists of business champions who are present in 100 villages and smart cash kiosks that are present in 10 villages.

India has about 200,000 villages with a population of more than 2000 people. The company is focused on targeting this demographic through an assisted model that consists of business champions who are present in 100 villages and smart cash kiosks that are present in 10 villages. India has about 200,000 villages with a population of more than 2000 people. The company is focused on targeting this demographic through an assisted model that consists of business champions who are present in 100 villages and smart cash kiosks that are present in 10 villages.

India has about 200,000 villages with a population of more than 2000 people. The company is focused on targeting this demographic through an assisted model that consists of business champions who are present in 100 villages and smart cash kiosks that are present in 10 villages. BSE-listed National Steel & Agro owes about Rs 1,600 crore to its lenders. On Friday, the Mumbai bench of the National Company Law Tribunal, presided over by Justice Pradeep Narhari Deshmukh, allowed the substitution of JM Financial ARC, to whom the lenders have assigned their debt as petitioner in an oral order and have posted the hearing of the matter to March 9.

BSE-listed National Steel & Agro owes about Rs 1,600 crore to its lenders. On Friday, the Mumbai bench of the National Company Law Tribunal, presided over by Justice Pradeep Narhari Deshmukh, allowed the substitution of JM Financial ARC, to whom the lenders have assigned their debt as petitioner in an oral order and have posted the hearing of the matter to March 9. BSE-listed National Steel & Agro owes about Rs 1,600 crore to its lenders. On Friday, the Mumbai bench of the National Company Law Tribunal, presided over by Justice Pradeep Narhari Deshmukh, allowed the substitution of JM Financial ARC, to whom the lenders have assigned their debt as petitioner in an oral order and have posted the hearing of the matter to March 9.

BSE-listed National Steel & Agro owes about Rs 1,600 crore to its lenders. On Friday, the Mumbai bench of the National Company Law Tribunal, presided over by Justice Pradeep Narhari Deshmukh, allowed the substitution of JM Financial ARC, to whom the lenders have assigned their debt as petitioner in an oral order and have posted the hearing of the matter to March 9. The Payments Council of India (PCI), the industry body for the digital payments ecosystem in the country, has written to the government urging it to roll back the zero MDR regime for UPI and Rupay debit cards transactions.

The Payments Council of India (PCI), the industry body for the digital payments ecosystem in the country, has written to the government urging it to roll back the zero MDR regime for UPI and Rupay debit cards transactions. The Payments Council of India (PCI), the industry body for the digital payments ecosystem in the country, has written to the government urging it to roll back the zero MDR regime for UPI and Rupay debit cards transactions.

The Payments Council of India (PCI), the industry body for the digital payments ecosystem in the country, has written to the government urging it to roll back the zero MDR regime for UPI and Rupay debit cards transactions. A two-member NCLAT bench, while disposing of SREI Infrastructure Finance Ltd (SIFL) petition observed that the National Company Law Tribunal (NCLT) has ordered a status quo and is yet to pass any order over the plea filed by the non-banking financial company.

A two-member NCLAT bench, while disposing of SREI Infrastructure Finance Ltd (SIFL) petition observed that the National Company Law Tribunal (NCLT) has ordered a status quo and is yet to pass any order over the plea filed by the non-banking financial company. A two-member NCLAT bench, while disposing of SREI Infrastructure Finance Ltd (SIFL) petition observed that the National Company Law Tribunal (NCLT) has ordered a status quo and is yet to pass any order over the plea filed by the non-banking financial company.

A two-member NCLAT bench, while disposing of SREI Infrastructure Finance Ltd (SIFL) petition observed that the National Company Law Tribunal (NCLT) has ordered a status quo and is yet to pass any order over the plea filed by the non-banking financial company. Fee income also recorded a strong growth of 19% year-on-year to Rs 4,291 crore from Rs 3,601 crore a year ago. Treasury income declined to Rs 88 crore from Rs 766 crore a year earlier because unlike last year income this year did not include a gain of Rs 329 crore from sale of shares of ICICI Securities.

Fee income also recorded a strong growth of 19% year-on-year to Rs 4,291 crore from Rs 3,601 crore a year ago. Treasury income declined to Rs 88 crore from Rs 766 crore a year earlier because unlike last year income this year did not include a gain of Rs 329 crore from sale of shares of ICICI Securities. Fee income also recorded a strong growth of 19% year-on-year to Rs 4,291 crore from Rs 3,601 crore a year ago. Treasury income declined to Rs 88 crore from Rs 766 crore a year earlier because unlike last year income this year did not include a gain of Rs 329 crore from sale of shares of ICICI Securities.

Fee income also recorded a strong growth of 19% year-on-year to Rs 4,291 crore from Rs 3,601 crore a year ago. Treasury income declined to Rs 88 crore from Rs 766 crore a year earlier because unlike last year income this year did not include a gain of Rs 329 crore from sale of shares of ICICI Securities.