Fox News Breaking News Alert

Supreme Court denies request to halt border wall construction

07/31/20 2:49 PM

bank, NBFC, loan, Credit Card ,General Awareness, finance knowledge RBI, saving account,current account, Fixed Deposit ,Recurring Deposit (RD) ,General Banking scheme ,

Friday, July 31, 2020

Fox News Breaking News Alert

Fox News Breaking News Alert

Federal appeals court vacates Boston Marathon bomber Dzhokhar Tsarnaev's death sentence

07/31/20 12:45 PM

Federal appeals court vacates Boston Marathon bomber Dzhokhar Tsarnaev's death sentence

07/31/20 12:45 PM

Banks' YoY credit growth at 6.7 per cent remains subdued in June

The slowdown in disbursement of new credit in this period has been attributed by bankers to challenges in conducting origination activities, lack of clarity in moratorium extension and risk averseness amid tell-tale signs of stress across sectors.

The slowdown in disbursement of new credit in this period has been attributed by bankers to challenges in conducting origination activities, lack of clarity in moratorium extension and risk averseness amid tell-tale signs of stress across sectors.source https://economictimes.indiatimes.com/industry/banking/finance/banking/banks-yoy-credit-growth-at-6-7-remains-subdued-in-june/articleshow/77289275.cms

BANKING

The slowdown in disbursement of new credit in this period has been attributed by bankers to challenges in conducting origination activities, lack of clarity in moratorium extension and risk averseness amid tell-tale signs of stress across sectors.

The slowdown in disbursement of new credit in this period has been attributed by bankers to challenges in conducting origination activities, lack of clarity in moratorium extension and risk averseness amid tell-tale signs of stress across sectors.from Banking/Finance-Industry-Economic Times https://ift.tt/318oYme

via IFTTT

Thursday, July 30, 2020

Rakesh Rathi's latest venture creating buzz for facilitating trade finance during the current pandemic

Mr. Rakesh Rathi dons many hats. He is a chartered account, entrepreneur and a technology enthusiast who has successfully created value for his group http:/...

Mr. Rakesh Rathi dons many hats. He is a chartered account, entrepreneur and a technology enthusiast who has successfully created value for his group http:/...source https://economictimes.indiatimes.com/industry/banking/finance/rakesh-rathis-latest-venture-creating-buzz-for-facilitating-trade-finance-during-the-current-pandemic/articleshow/77276389.cms

Deadline for proposed Lakshmi Vilas Bank-Clix Capital merger due diligence extended till Sept 14

"There may be slight delay in the mutual due diligence and preparation of documents for regulatory requirements due to Covid situation and travel restrictions. Hence, both the parties mutually agreed to extend the exclusivity period till 15th September 2020," the bank said on Thursday evening.

"There may be slight delay in the mutual due diligence and preparation of documents for regulatory requirements due to Covid situation and travel restrictions. Hence, both the parties mutually agreed to extend the exclusivity period till 15th September 2020," the bank said on Thursday evening.source https://economictimes.indiatimes.com/industry/banking/finance/banking/deadline-for-proposed-lakshmi-vilas-bank-clix-capital-merger-due-diligence-extended-till-sept-14/articleshow/77266320.cms

BANKING

"There may be slight delay in the mutual due diligence and preparation of documents for regulatory requirements due to Covid situation and travel restrictions. Hence, both the parties mutually agreed to extend the exclusivity period till 15th September 2020," the bank said on Thursday evening.

"There may be slight delay in the mutual due diligence and preparation of documents for regulatory requirements due to Covid situation and travel restrictions. Hence, both the parties mutually agreed to extend the exclusivity period till 15th September 2020," the bank said on Thursday evening.from Banking/Finance-Industry-Economic Times https://ift.tt/39I8NjO

via IFTTT

BANKING

For the retail borrowers in banks, the share of moratorium loans came down to 45% in the phase 2 of moratorium against 60% phase 1. For corporate borrowers moratorium levels declined to 17.5% against 25%, the research shows.

For the retail borrowers in banks, the share of moratorium loans came down to 45% in the phase 2 of moratorium against 60% phase 1. For corporate borrowers moratorium levels declined to 17.5% against 25%, the research shows.from Banking/Finance-Industry-Economic Times https://ift.tt/3hOwFVA

via IFTTT

Fox News Breaking News Alert

Fox News Breaking News Alert

Herman Cain dies at age 74: reports

07/30/20 7:39 AM

Herman Cain dies at age 74: reports

07/30/20 7:39 AM

System-wide loan moratorium down to 25% due to resumption in business activities: Acuité Ratings

For the retail borrowers in banks, the share of moratorium loans came down to 45% in the phase 2 of moratorium against 60% phase 1. For corporate borrowers moratorium levels declined to 17.5% against 25%, the research shows.

For the retail borrowers in banks, the share of moratorium loans came down to 45% in the phase 2 of moratorium against 60% phase 1. For corporate borrowers moratorium levels declined to 17.5% against 25%, the research shows.source https://economictimes.indiatimes.com/industry/banking/finance/system-wide-loan-moratorium-down-to-25-due-to-resumption-in-business-activities-acuit-ratings/articleshow/77265575.cms

YES Bank looks to carve out technology platform, transfer stressed assets to two arms: MD

The lender is creating a structure for what will be an in-house bad bank that will house all its bad loans and also buy bad assets from other lenders.

The lender is creating a structure for what will be an in-house bad bank that will house all its bad loans and also buy bad assets from other lenders.source https://economictimes.indiatimes.com/industry/banking/finance/banking/yes-bank-looks-to-carve-out-technology-platform-transfer-stressed-assets-to-two-arms-md/articleshow/77261770.cms

Fox News Breaking News Alert

Fox News Breaking News Alert

NASA’s Mars 2020 Perseverance Rover launches epic mission to Red Planet

07/30/20 4:57 AM

NASA’s Mars 2020 Perseverance Rover launches epic mission to Red Planet

07/30/20 4:57 AM

Managing Volatility And Rebalancing

SSL Academy, in association with the Economic Times, organised a three-day digital conference titled ‘Financial Freedom Fraternity’ for financial advisors a...

SSL Academy, in association with the Economic Times, organised a three-day digital conference titled ‘Financial Freedom Fraternity’ for financial advisors a...source https://economictimes.indiatimes.com/industry/banking/finance/managing-volatility-and-rebalancing/articleshow/77258744.cms

Wednesday, July 29, 2020

BANKING

The audit, which took place over four months to February 2019, highlighted a lack of encryption of personal data at the National Payments Corporation of India (NPCI) which forms the backbone of the country's digital payments system and operates the RuPay card network championed by Prime Minister Narendra Modi.

The audit, which took place over four months to February 2019, highlighted a lack of encryption of personal data at the National Payments Corporation of India (NPCI) which forms the backbone of the country's digital payments system and operates the RuPay card network championed by Prime Minister Narendra Modi.from Banking/Finance-Industry-Economic Times https://ift.tt/3jMMT3g

via IFTTT

India found cybersecurity lapses at National Payments Corporation in 2019: Govt document

The audit, which took place over four months to February 2019, highlighted a lack of encryption of personal data at the National Payments Corporation of India (NPCI) which forms the backbone of the country's digital payments system and operates the RuPay card network championed by Prime Minister Narendra Modi.

The audit, which took place over four months to February 2019, highlighted a lack of encryption of personal data at the National Payments Corporation of India (NPCI) which forms the backbone of the country's digital payments system and operates the RuPay card network championed by Prime Minister Narendra Modi.source https://economictimes.indiatimes.com/industry/banking/finance/india-found-cybersecurity-lapses-at-national-payments-corporation-in-2019-govt-document/articleshow/77254889.cms

Rural-play fintech firms see revival as rural economy starts getting back on its feet

Companies providing intermediary payments, banking and insurance services to rural customers have seen a sharp recovery in June and July, from the initial shock of the nationwide lockdown that brought supply chains and merchant commerce across the country to a standstill.

Companies providing intermediary payments, banking and insurance services to rural customers have seen a sharp recovery in June and July, from the initial shock of the nationwide lockdown that brought supply chains and merchant commerce across the country to a standstill.source https://economictimes.indiatimes.com/industry/banking/finance/rural-play-fintech-firms-see-revival-as-rural-economy-starts-getting-back-on-its-feet/articleshow/77252701.cms

BANKING

Companies providing intermediary payments, banking and insurance services to rural customers have seen a sharp recovery in June and July, from the initial shock of the nationwide lockdown that brought supply chains and merchant commerce across the country to a standstill.

Companies providing intermediary payments, banking and insurance services to rural customers have seen a sharp recovery in June and July, from the initial shock of the nationwide lockdown that brought supply chains and merchant commerce across the country to a standstill.from Banking/Finance-Industry-Economic Times https://ift.tt/308XEVY

via IFTTT

Fox News Breaking News Alert

Fox News Breaking News Alert

Apple, Google, Facebook, Amazon CEOs grilled on Capitol Hill in wide-ranging hearing

07/29/20 3:47 PM

Apple, Google, Facebook, Amazon CEOs grilled on Capitol Hill in wide-ranging hearing

07/29/20 3:47 PM

Suspending IBC for a year bad idea, restart bankruptcy courts in 2-3 months: Viral Acharya

Acharya, who went back to New York as a professor of economics after quitting his job at the RBI six months before the end of his three-year term, said bankruptcy should not be seen as a punishment, but as a way to restructure debts and pitched for the courts to reopen in the next two to three months.

Acharya, who went back to New York as a professor of economics after quitting his job at the RBI six months before the end of his three-year term, said bankruptcy should not be seen as a punishment, but as a way to restructure debts and pitched for the courts to reopen in the next two to three months.source https://economictimes.indiatimes.com/industry/banking/finance/banking/suspending-ibc-for-a-year-bad-idea-restart-bankruptcy-courts-in-2-3-months-viral-acharya/articleshow/77245844.cms

Over 45% of the urban Indians are planning to increase their health insurance spending

The study forecasts not only a sharp rise in demand for health insurance products over the upcoming months but also an increased influence of digital modes for insurance purchases.

The study forecasts not only a sharp rise in demand for health insurance products over the upcoming months but also an increased influence of digital modes for insurance purchases.source https://economictimes.indiatimes.com/industry/banking/finance/insure/over-45-of-the-urban-indians-are-planning-to-increase-their-health-insurance-spending/articleshow/77245245.cms

BANKING

Acharya, who went back to New York as a professor of economics after quitting his job at the RBI six months before the end of his three-year term, said bankruptcy should not be seen as a punishment, but as a way to restructure debts and pitched for the courts to reopen in the next two to three months.

Acharya, who went back to New York as a professor of economics after quitting his job at the RBI six months before the end of his three-year term, said bankruptcy should not be seen as a punishment, but as a way to restructure debts and pitched for the courts to reopen in the next two to three months.from Banking/Finance-Industry-Economic Times https://ift.tt/2D0yuzR

via IFTTT

BANKING

The ex-central banker was referring to Japan’s experience in the 1990s when a weak banking and financial sector crippled activity and contributed to a lost decade of sub-par economic growth. The RBI sees the country’s bad-loan ratio swelling to the highest level in more than two decades — to 12.5% by March 2021, the highest level since 1999.

The ex-central banker was referring to Japan’s experience in the 1990s when a weak banking and financial sector crippled activity and contributed to a lost decade of sub-par economic growth. The RBI sees the country’s bad-loan ratio swelling to the highest level in more than two decades — to 12.5% by March 2021, the highest level since 1999.from Banking/Finance-Industry-Economic Times https://ift.tt/3jX0XYj

via IFTTT

India risks ‘Japanification’ as bad loans surge, says Viral Acharya

The ex-central banker was referring to Japan’s experience in the 1990s when a weak banking and financial sector crippled activity and contributed to a lost decade of sub-par economic growth. The RBI sees the country’s bad-loan ratio swelling to the highest level in more than two decades — to 12.5% by March 2021, the highest level since 1999.

The ex-central banker was referring to Japan’s experience in the 1990s when a weak banking and financial sector crippled activity and contributed to a lost decade of sub-par economic growth. The RBI sees the country’s bad-loan ratio swelling to the highest level in more than two decades — to 12.5% by March 2021, the highest level since 1999.source https://economictimes.indiatimes.com/industry/banking/finance/banking/india-risks-japanification-as-bad-loans-surge-says-viral-acharya/articleshow/77238015.cms

Tuesday, July 28, 2020

BANKING

Yes Bank was privately owned, before it was quasi-nationalized by making it SBI’s problem. But next year, there will be several small state-owned banks in a similar situation where capital buffers are depleted. This can’t happen yet because of RBI's Covid moratorium on repayments. When the freeze ends next month, loans will start turning overdue.

Yes Bank was privately owned, before it was quasi-nationalized by making it SBI’s problem. But next year, there will be several small state-owned banks in a similar situation where capital buffers are depleted. This can’t happen yet because of RBI's Covid moratorium on repayments. When the freeze ends next month, loans will start turning overdue.from Banking/Finance-Industry-Economic Times https://ift.tt/39IluuL

via IFTTT

View: Yes Bank is a zombie. India must learn before more bailouts

Yes Bank was privately owned, before it was quasi-nationalized by making it SBI’s problem. But next year, there will be several small state-owned banks in a similar situation where capital buffers are depleted. This can’t happen yet because of RBI's Covid moratorium on repayments. When the freeze ends next month, loans will start turning overdue.

Yes Bank was privately owned, before it was quasi-nationalized by making it SBI’s problem. But next year, there will be several small state-owned banks in a similar situation where capital buffers are depleted. This can’t happen yet because of RBI's Covid moratorium on repayments. When the freeze ends next month, loans will start turning overdue.source https://economictimes.indiatimes.com/industry/banking/finance/banking/view-yes-bank-is-a-zombie-india-must-learn-before-more-bailouts/articleshow/77234087.cms

Fox News Breaking News Alert

Fox News Breaking News Alert

Trump administration halts new DACA applications as it considers canceling program

07/28/20 1:53 PM

Trump administration halts new DACA applications as it considers canceling program

07/28/20 1:53 PM

Fox News Breaking News Alert

Fox News Breaking News Alert

Barr spars with Dems on Trump ties, riots at fiery House hearing

07/28/20 1:08 PM

Barr spars with Dems on Trump ties, riots at fiery House hearing

07/28/20 1:08 PM

Fox News Breaking News Alert

Fox News Breaking News Alert

Miami Marlins' season on pause as coronavirus outbreak hampers club

07/28/20 12:22 PM

Miami Marlins' season on pause as coronavirus outbreak hampers club

07/28/20 12:22 PM

Cautious approach makes RBL Bank confident of maintaining asset quality

The bank has consiously avoided taking bulky loan exposures in the last one year as it brought NPAs under control which had spiralled last fiscal due to loan exposures to Cafe Coffee Day and stressed companies in the media and real estate sectors.

The bank has consiously avoided taking bulky loan exposures in the last one year as it brought NPAs under control which had spiralled last fiscal due to loan exposures to Cafe Coffee Day and stressed companies in the media and real estate sectors.source https://economictimes.indiatimes.com/industry/banking/finance/banking/cautious-approach-makes-rbl-bank-confident-of-maintaining-asset-quality/articleshow/77227532.cms

BANKING

The bank has consiously avoided taking bulky loan exposures in the last one year as it brought NPAs under control which had spiralled last fiscal due to loan exposures to Cafe Coffee Day and stressed companies in the media and real estate sectors.

The bank has consiously avoided taking bulky loan exposures in the last one year as it brought NPAs under control which had spiralled last fiscal due to loan exposures to Cafe Coffee Day and stressed companies in the media and real estate sectors.from Banking/Finance-Industry-Economic Times https://ift.tt/3hKHXtQ

via IFTTT

BANKING

While the gross bank credit to industry has contracted by 1.5 per cent in the current financial year, up to the third week of May, dis-aggregate RBI data points towards a huge decline in gross bank credit deployment in sectors like fertiliser (down 29%), chemicals and chemical products (- 10%) and glass and glassware (7%), Assocham stated.

While the gross bank credit to industry has contracted by 1.5 per cent in the current financial year, up to the third week of May, dis-aggregate RBI data points towards a huge decline in gross bank credit deployment in sectors like fertiliser (down 29%), chemicals and chemical products (- 10%) and glass and glassware (7%), Assocham stated.from Banking/Finance-Industry-Economic Times https://ift.tt/333ZQQw

via IFTTT

Few takers for bank loans, says industry body Assocham

While the gross bank credit to industry has contracted by 1.5 per cent in the current financial year, up to the third week of May, dis-aggregate RBI data points towards a huge decline in gross bank credit deployment in sectors like fertiliser (down 29%), chemicals and chemical products (- 10%) and glass and glassware (7%), Assocham stated.

While the gross bank credit to industry has contracted by 1.5 per cent in the current financial year, up to the third week of May, dis-aggregate RBI data points towards a huge decline in gross bank credit deployment in sectors like fertiliser (down 29%), chemicals and chemical products (- 10%) and glass and glassware (7%), Assocham stated.source https://economictimes.indiatimes.com/industry/banking/finance/banking/few-takers-for-bank-loans-says-industry-body-assocham/articleshow/77224682.cms

Fino Payments Bank aims to double gold loan sourcing to Rs 2,000 crore in FY21

Fino, which turned profitable last fiscal, has already facilitated gold loan sourcing worth Rs 1,000 crore in FY2020 as a corporate business correspondent (BC) for a leading bank, it said.

Fino, which turned profitable last fiscal, has already facilitated gold loan sourcing worth Rs 1,000 crore in FY2020 as a corporate business correspondent (BC) for a leading bank, it said.source https://economictimes.indiatimes.com/industry/banking/finance/banking/fino-payments-bank-aims-to-double-gold-loan-sourcing-to-rs-2000-crore-in-fy21/articleshow/77219777.cms

Manappuram Finance board approves plan to raise Rs 500 crore via bonds

The committee approved the issuance of private placement of rated, redeemable non-convertible debentures for an amount of Rs 150 crore with an option to retain over subscription up to Rs 350 crore aggregating to Rs 500 crore, it added.

The committee approved the issuance of private placement of rated, redeemable non-convertible debentures for an amount of Rs 150 crore with an option to retain over subscription up to Rs 350 crore aggregating to Rs 500 crore, it added.source https://economictimes.indiatimes.com/markets/bonds/manappuram-finance-board-approves-plan-to-raise-rs-500-crore-via-bonds/articleshow/77217118.cms

BANKING

The committee approved the issuance of private placement of rated, redeemable non-convertible debentures for an amount of Rs 150 crore with an option to retain over subscription up to Rs 350 crore aggregating to Rs 500 crore, it added.

The committee approved the issuance of private placement of rated, redeemable non-convertible debentures for an amount of Rs 150 crore with an option to retain over subscription up to Rs 350 crore aggregating to Rs 500 crore, it added.from Banking/Finance-Industry-Economic Times https://ift.tt/39Bh5tn

via IFTTT

Monday, July 27, 2020

Fox News Breaking News Alert

Fox News Breaking News Alert

WATCH LIVE: Casket of Congressman John Lewis carried into Capitol Rotunda by honor guard

07/27/20 10:25 AM

WATCH LIVE: Casket of Congressman John Lewis carried into Capitol Rotunda by honor guard

07/27/20 10:25 AM

BANKING

RTI (Right to Information) activist Abhay Kolarkar said that he had sought various banking related queries under the jurisdiction of the RBI in June 2020, and the replies to the same he received a few days back. During July 1, 2019 to March 2020, about 2,14,480 complaints were received.

RTI (Right to Information) activist Abhay Kolarkar said that he had sought various banking related queries under the jurisdiction of the RBI in June 2020, and the replies to the same he received a few days back. During July 1, 2019 to March 2020, about 2,14,480 complaints were received.from Banking/Finance-Industry-Economic Times https://ift.tt/3hDM7nq

via IFTTT

About 84,545 bank fraud cases reported during 2019-2020, says RBI, in reply to RTI

RTI (Right to Information) activist Abhay Kolarkar said that he had sought various banking related queries under the jurisdiction of the RBI in June 2020, and the replies to the same he received a few days back. During July 1, 2019 to March 2020, about 2,14,480 complaints were received.

RTI (Right to Information) activist Abhay Kolarkar said that he had sought various banking related queries under the jurisdiction of the RBI in June 2020, and the replies to the same he received a few days back. During July 1, 2019 to March 2020, about 2,14,480 complaints were received.source https://economictimes.indiatimes.com/industry/banking/finance/banking/about-84545-bank-fraud-cases-reported-during-2019-2020-says-rbi-in-reply-to-rti/articleshow/77200022.cms

Majority consider health insurance cover as a necessity in post-COVID era, says survey

Before the outbreak of coronavirus pandemic in India only 10 per cent of people were interested in buying health insurance to cover new age diseases, but now 71 per cent people consider health insurance as a necessity to fight unforeseen pandemic like this, the survey said.

Before the outbreak of coronavirus pandemic in India only 10 per cent of people were interested in buying health insurance to cover new age diseases, but now 71 per cent people consider health insurance as a necessity to fight unforeseen pandemic like this, the survey said.source https://economictimes.indiatimes.com/industry/banking/finance/insure/majority-consider-health-insurance-cover-as-a-necessity-in-post-covid-era-says-survey/articleshow/77197816.cms

BANKING

Before the outbreak of coronavirus pandemic in India only 10 per cent of people were interested in buying health insurance to cover new age diseases, but now 71 per cent people consider health insurance as a necessity to fight unforeseen pandemic like this, the survey said.

Before the outbreak of coronavirus pandemic in India only 10 per cent of people were interested in buying health insurance to cover new age diseases, but now 71 per cent people consider health insurance as a necessity to fight unforeseen pandemic like this, the survey said.from Banking/Finance-Industry-Economic Times https://ift.tt/32Zyx9F

via IFTTT

BANKING

“Please do not extend the moratorium because we see that even people who have the ability to pay whether it’s individuals or corporates are taking advantage under moratorium and deferring payments,” Parekh appealed to RBI Governor Shaktikanta Das.

“Please do not extend the moratorium because we see that even people who have the ability to pay whether it’s individuals or corporates are taking advantage under moratorium and deferring payments,” Parekh appealed to RBI Governor Shaktikanta Das.from Banking/Finance-Industry-Economic Times https://ift.tt/30OEAvk

via IFTTT

3 P's of Smart Investing

Making an investment plan involves more than just choosing the right product to put money in. One has to consider the financial situation, risk appetite and...

Making an investment plan involves more than just choosing the right product to put money in. One has to consider the financial situation, risk appetite and...source https://economictimes.indiatimes.com/industry/banking/finance/3-ps-of-smart-investing/articleshow/77196676.cms

HDFC chairman Deepak Parekh requests RBI Governor to not extend loan moratorium

“Please do not extend the moratorium because we see that even people who have the ability to pay whether it’s individuals or corporates are taking advantage under moratorium and deferring payments,” Parekh appealed to RBI Governor Shaktikanta Das.

“Please do not extend the moratorium because we see that even people who have the ability to pay whether it’s individuals or corporates are taking advantage under moratorium and deferring payments,” Parekh appealed to RBI Governor Shaktikanta Das.source https://economictimes.indiatimes.com/industry/banking/finance/banking/hdfc-chairman-deepak-parekh-requests-rbi-governor-to-not-extend-loan-moratorium/articleshow/77195686.cms

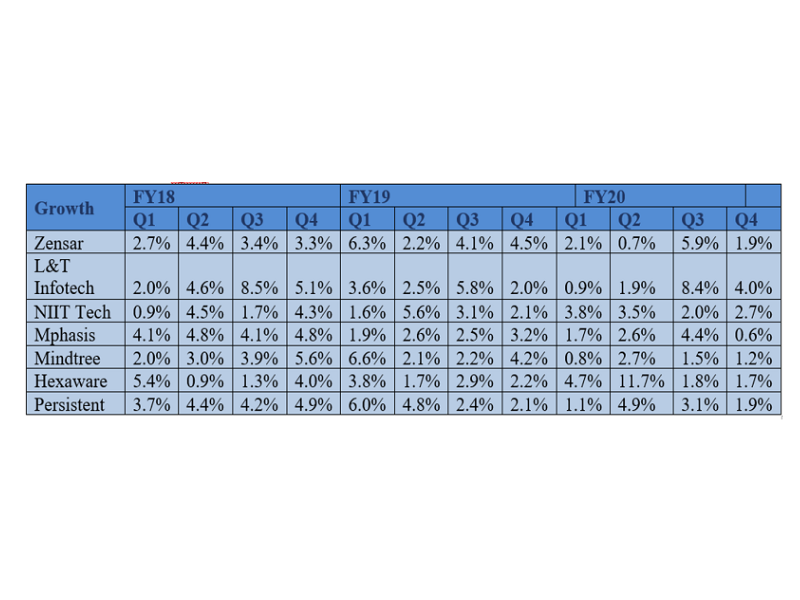

The relative performance of Mid-cap IT Services firms — and how a crisis is differentiating the winners from the also-rans

The Covid-19 pandemic has been the black swan event that no one saw. The crisis is likely to further differentiate the few mid-cap IT firms that have shown r...

The Covid-19 pandemic has been the black swan event that no one saw. The crisis is likely to further differentiate the few mid-cap IT firms that have shown r...source https://economictimes.indiatimes.com/industry/banking/finance/the-relative-performance-of-mid-cap-it-services-firms-and-how-a-crisis-is-differentiating-the-winners-from-the-also-rans/articleshow/77192928.cms

HDIL's creditors reject resignation of CFO and company secretary Darshan Majmudar

In a regulatory filing, Housing Development and Infrastructure Ltd (HDIL) informed that the CoC rejected the resignation tendered by Majmudar, and directed him to continue in his present role.

In a regulatory filing, Housing Development and Infrastructure Ltd (HDIL) informed that the CoC rejected the resignation tendered by Majmudar, and directed him to continue in his present role.source https://economictimes.indiatimes.com/industry/banking/finance/hdils-creditors-reject-resignation-of-cfo-and-company-secretary-darshan-majmudar/articleshow/77192003.cms

Sunday, July 26, 2020

As prices of gold reach new heights, some see a golden chance to settle their loans

According to RBI regulations, up to 75% of the value of the gold can be lent. Rising gold prices have meant that loan-to-value (LTV) is higher by Rs 500 per gram on the same jewellery.

According to RBI regulations, up to 75% of the value of the gold can be lent. Rising gold prices have meant that loan-to-value (LTV) is higher by Rs 500 per gram on the same jewellery.source https://economictimes.indiatimes.com/industry/banking/finance/as-prices-of-gold-reach-new-heights-some-see-a-golden-chance-to-settle-their-loans/articleshow/77190747.cms

Fox News Breaking News Alert

Fox News Breaking News Alert

WATCH LIVE: “Remembering Representative John Lewis,” from 11 am-12 pm ET, on Fox News Channel and FoxNews.com

07/26/20 7:55 AM

WATCH LIVE: “Remembering Representative John Lewis,” from 11 am-12 pm ET, on Fox News Channel and FoxNews.com

07/26/20 7:55 AM

PNB Housing Finance expects to disburse Rs 13,000 crore loan this fiscal: MD and CEO Neeraj Vyas

Demand from mass housing statement has started picking up post relaxations in coronavirus-induced lockdowns and gradual reopening of economy, he said.

Demand from mass housing statement has started picking up post relaxations in coronavirus-induced lockdowns and gradual reopening of economy, he said.source https://economictimes.indiatimes.com/industry/banking/finance/banking/pnb-housing-finance-expects-to-disburse-rs-13000-crore-loan-this-fiscal-md-and-ceo-neeraj-vyas/articleshow/77182299.cms

BANKING

SAVE Solutions is a business correspondent for State Bank of India, Bank of India and Bank of Baroda and intends to use this capital to expand its direct lending through subsidiaries SAVE Microfinance and SAVE Financial Services, group chief financial officer Gourav Sirohi told ET.

SAVE Solutions is a business correspondent for State Bank of India, Bank of India and Bank of Baroda and intends to use this capital to expand its direct lending through subsidiaries SAVE Microfinance and SAVE Financial Services, group chief financial officer Gourav Sirohi told ET.from Banking/Finance-Industry-Economic Times https://ift.tt/3f2RA5A

via IFTTT

Danish company Maj Invest buys 18% equity in SAVE Solutions for Rs 120 crore

SAVE Solutions is a business correspondent for State Bank of India, Bank of India and Bank of Baroda and intends to use this capital to expand its direct lending through subsidiaries SAVE Microfinance and SAVE Financial Services, group chief financial officer Gourav Sirohi told ET.

SAVE Solutions is a business correspondent for State Bank of India, Bank of India and Bank of Baroda and intends to use this capital to expand its direct lending through subsidiaries SAVE Microfinance and SAVE Financial Services, group chief financial officer Gourav Sirohi told ET.source https://economictimes.indiatimes.com/industry/banking/finance/danish-company-maj-invest-buys-18-equity-in-save-solutions-for-rs-120-crore/articleshow/77180765.cms

Subscribe to:

Comments (Atom)