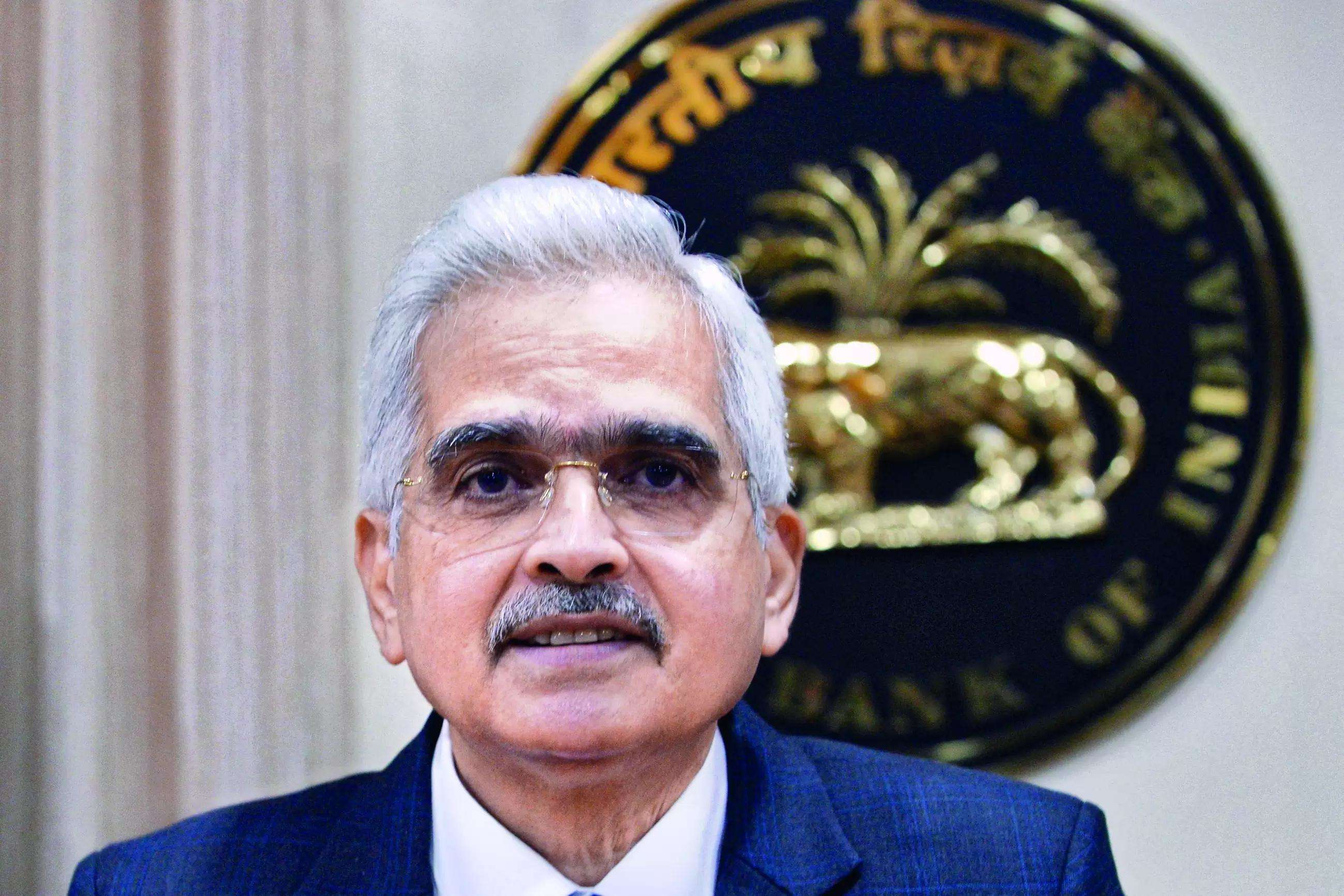

Lenders in India have requested the Reserve Bank of India (RBI) to double the housing loan amount considered as priority sector lending. Currently, a housing loan of ₹35 lakh in a metropolitan city is considered priority sector lending. The lenders argue that this amount does not reflect the current real estate prices, which have increased since the limits were set in 2018.

Lenders in India have requested the Reserve Bank of India (RBI) to double the housing loan amount considered as priority sector lending. Currently, a housing loan of ₹35 lakh in a metropolitan city is considered priority sector lending. The lenders argue that this amount does not reflect the current real estate prices, which have increased since the limits were set in 2018.from Banking/Finance-Industry-Economic Times https://ift.tt/EW2kdw8

via IFTTT